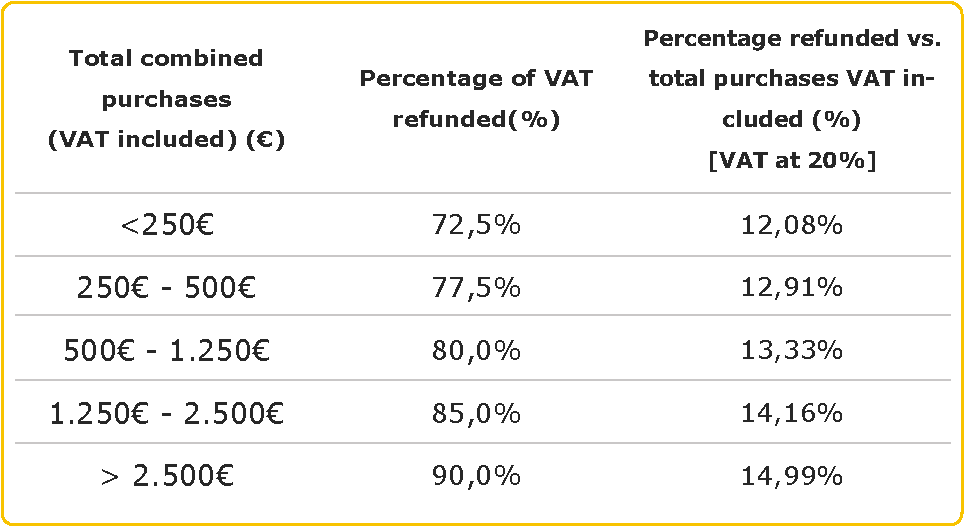

One easy hack to fight inflation during your holidays - use Zapptax and save up to 19% on your purchases in Belgium

You should know that as a non-resident of the EU, you have the right to have the VAT reimbursed for anything you buy in Belgium and take home with you. Zapptax has made the tax-free shopping easy by streamlining the process and providing 24/7 customer service, with any of the old administrative hassle.

Something to keep in mind for your next holidays in Belgium!

How to shop tax-free with Zapptax

You will simply need to request an invoice in the name of ZappTax when making your in-store-purchase, upload it to the app, click to get your tax-free form generated, and then present it to custom before leaving the EU. You’ll then receive your refund within a few days.

If you don't have time to get to all the stores you’d like, it’s just as easy to shop tax-free online. You can order your products before arriving in Belgium and have them delivered there (to your hotel, for example). You will simply need to ensure that the e-merchant issues the invoice in the name and address of Zapptax (see details on our FAQ, question #18), and then bring them back with you when you leave!

Legal explanation by the European Commission

On its website, the European Commission states that “in the European Union, value added tax, or VAT, [...] more or less applies to all goods and services bought and sold in order to be used or consumed in the European Union. Thus, goods sold for export [...] outside the EU are normally not subjected to VAT.”

Happy Tax-Free shopping !